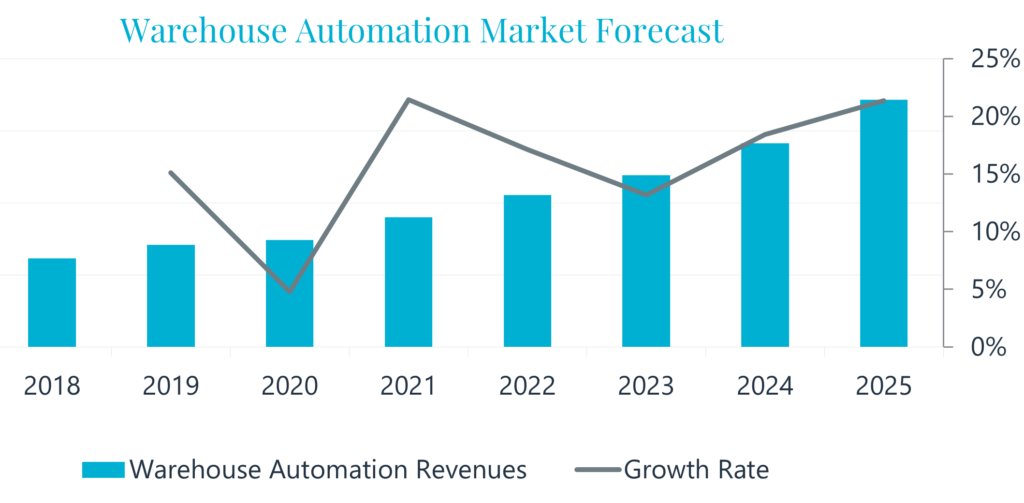

A report by market research firm Interact Analysis has predicted that the global warehouse automation market will more than double over the next five years, expanding from US$29.6bn in 2020 to US$69bn in 2025.

According to the research, mixed automation such as automated storage and retrieval systems (AS/RS), conveyors and conveyor-based sorters will remain the most common form of automation for the foreseeable future, but there is apparently a rapidly growing trend for warehouses to adopt more flexible mobile automation solutions.

Owing to the pandemic, many companies saw a plateau in warehouse automation revenue, while order intake increased significantly. This was due to delays in project completion and supply chain limitations. As a result of this, Interact Analysis predicts that between 2021 and 2022 the warehouse automation market will endure a period of stabilization as the market re-equilibrates and catches up on the back log of orders. By 2022 the market will have returned to normal and will be facing a permanently accelerated rate of post-pandemic growth.

Dematic and Honeywell Intelligrated continue to retain the greatest market share. Dematic leads the way, with 10% of the market and impressive revenue growth of 31% in 2020 (compared to 14% in 2019). Meanwhile, Honeywell Intelligrated grew by 13% in 2020. Interestingly, Knapp’s order intake grew by 55% in 2020 while their revenues decreased by 1% due to project delays caused by the pandemic.

Driven by China and Japan, Asia-Pacific (APAC) retains its title of having the largest market share for warehouse automation with a market size of US$11bn in 2020. A significant proportion of growth within the Americas and EMEA markets is predicted to come from the general merchandise and grocery sectors. Interestingly, these sectors are less prominent in APAC, where together they account for 29% of the warehouse automation market (compared to 42% and 45% of EMEA and the Americas respectively).

Rueben Scriven, senior analyst at Interact Analysis said, “The general merchandise segment is the single largest segment in warehouse automation, and it is predicted to grow at a faster rate than the overall market, with revenues hitting US$20bn by 2025. General merchandise is driven by companies such as JD.com, Amazon and Target, all of which have heavily benefited from the Covid-inspired e-commerce boost. By 2025, general merchandise will account for 28% of the market. However, the single fastest growing vertical market is grocery, which is projected to grow from 12% of the market in 2020 to 16% in 2025.”