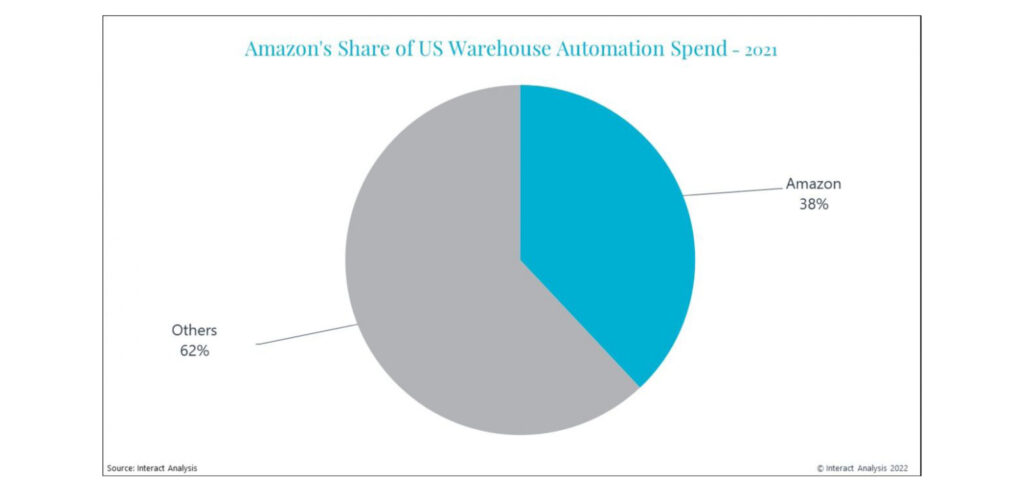

Amazon has a huge influence on the state of the warehouse automation market. In fact, Amazon accounted for more than 35% of total investment in warehouse automation in the USA in 2021. When Amazon reported its Q1 loss – the first quarterly loss since 2015 – CFO Brian Olsavsky cited overcapacity of fulfillment space as a key reason, stating that Amazon would slow down its investments in new fulfillment centers. This insight explores the impact that Amazon’s announcement will have on the warehouse automation market and whether this points toward wider market slow down.

E-commerce reverts to pre-pandemic expectations

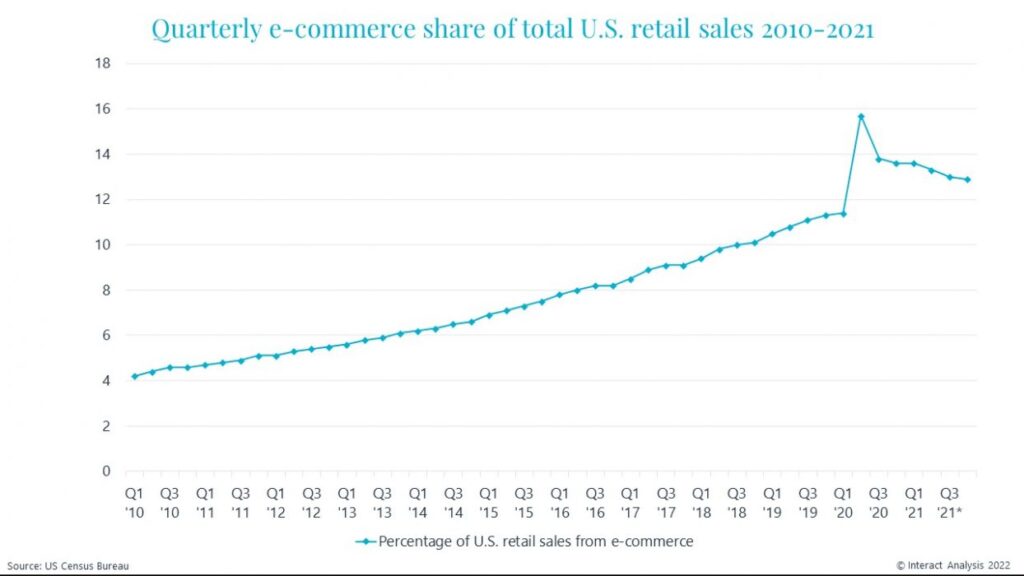

Over the past few years, e-commerce has seen massive growth because of the Covid pandemic. According to U.S Census Bureau data, the share of total US retail sales coming from e-commerce rose from 11.9% in Q1 2020 to 16.4% in Q2 of 2020, creating a sudden need for additional fulfillment capacity to cope with demand. Amazon looked to capitalize on this by expanding its warehousing network. According to its annual reports, Amazon’s total warehouse square footage went from 272 million at the end of 2019 to 525 million at the end of 2021. However, it is important to emphasize that not all of this will be used purely for fulfillment. Amazon has made an effort to expand its delivery station network, used to shorten delivery times to customers and improve efficiencies in delivery rather than to hold inventory. Nonetheless this increase in warehousing assets was larger than any other retailer.

However, as the restrictions were lifted, customers were given the choice between continuing to shop online or to shop instore. Once this became an option, many customers started to revert to their former preference and shop in person. Another factor influencing this is the additional cost of delivery with e-commerce services. For many, the effects of inflation and rising living costs have encouraged shoppers to save the delivery fee and use brick-and-mortar stores.

With the drop in e-commerce sales in Q1 of 2022, e-demand has steadied to reflect natural growth prior to the pandemic. If the pandemic had not reduced shoppers’ options, it is likely the e-commerce sales would have grown at a steady rate toward the current demand.

Amazon’s first quarterly loss since 2015

In Q1 2022 Amazon reported its first quarterly loss since 2015. According to sources, the net loss of US$3.8bn resulted in the share price dropping by 12% within a day, after the announcement. There are many factors attributing to the company’s loss, but it is mainly centered around the increased operating costs and excess capacity from doubling its warehouse space in 24 months. Despite the loss, Amazon CFO Olsavsky explained that the expansion was necessary despite the recent drop in e-commerce demand. He said to reporters, “We did not want space to be constrained. Even with that intent, it took until the second quarter of last year for us to feel like we had enough space. And then we continued to add warehouses for the peak last year in Q4”. He went on to say these expansion plans are made years in advance and cannot be altered as the demand shifts mid-year.

The CFO also believes that Amazon will fill the under-utilized space in Q3 and Q4. However, Amazon also reported over US$2bn of costs related to the excess capacity. According to Olsavsky, these costs are expected to be around for some time. The CFO has also announced they will slow down their expansion plans this year and slow down spending on fulfillment so it can maximize the efficiency of its current space. The company also plans to sub-let up to 30,000,000ft2 of its warehouse space.

Accounting for more than 35% of the demand for warehouse automation in the USA in 2021, Amazon’s slowdown will certainly have a big impact on the overall market. Our latest analysis suggests that Amazon’s investments in warehouse automation will decrease by 26% in 2022 relative to its spend in 2021.

How Amazon’s competitors are fairing

While Amazon may slow down its investments in warehouse automation, we don’t expect that other retailers will significantly alter their investment plans, especially large brick-and-mortar retailers in the early stages of their automation journeys. Walmart, for example, is working with Symbotic to automate 25 of its 42 food store-replenishment distribution centers, and all 42 of its regional distribution centers across the USA. Recessions often lead to more supermarket sales which will further motivate Walmart to continue on its automation path.

Target’s planned US$5bn capital expenditures on supply chain automation also likely won’t be affected by current economic environment. Another advantage for brick-and-mortar retailers such as Walmart and Target are their store assets. As the pandemic has waned, many consumers have returned to shop in store. However, Target’s store-based fulfillment strategy means that fluctuations in e-commerce demand will have less impact on the utilization of its fulfillment assets, unlike Amazon. Uncertainty around future e-commerce sales will likely push more brick-and-mortar retailers to shift their fulfillment operations from dedicated facilities to their physical stores. Instead of investing in automation for dedicated fulfillment centers, Target is focusing on improving the efficiency of how stock is shipped to stores, which subsequently increases the efficiency of its fulfillment operation. As a result, Target will be more inclined to continue investing in automation as that improves the efficiency of its entire operation and not just its online business.

While Amazon invests significantly more in warehouse automation than Target and Walmart combined, it’s likely that increased investments from these companies will somewhat offset the slowdown in Amazon’s future spending.

Potential upside due to labor shortages

Another reason for Amazon’s Q1 loss was increased operating expenses. This came from both increased fuel costs and increased labor costs. Labor shortages have been an issue within the warehousing industry for a while, however, the supply chain crises have further compounded operating costs. Furthermore, Amazon has also faced labor issues relating to the first unionization of a warehouse in Staten Island which may further accelerate operating cost increases in the future.

Operating costs for Amazon’s US business rose by 16% in Q1 2022 compared to the same period last year. This was two percentage points higher than Target and more than 10 percentage points higher than Walmart. While cost of sales increased by 18.9% year on year for Amazon, the cost of fulfillment increased 28.4%.

As Amazon’s operating costs increase with more potential issues down the road because of its unionization defeat, Amazon may look to invest more in increasing the efficiency of its existing facilities. While Amazon accounts for more than 35% of warehouse automation spending in the USA, it may seem counterintuitive that its facilities remain fairly manual in comparison to some of the highly automated facilities such as those installed by Witron. As a result, there’s a fairly sizable opportunity to increase the level of automation in its existing facilities.

The question is therefore whether Amazon’s potential retrofitting investments will offset its reduced greenfield automation investments. Probably not. However, with Walmart and Target increasing their investments over the coming years, Amazon’s slow-down of its fulfillment center network expansion may not be a terrible thing for the industry. Indeed, many companies have been put off from purchasing warehouse automation equipment due to the extremely long lead times as a result of companies like Amazon keeping the automation vendors very busy.

Likewise, we’re not experiencing a slow-down in e-commerce sales, but rather a correction. The structural drivers are still in play and we expect continued high growth for warehouse automation sales in the long-term.

This article was originally published here.