Delivery experience platform FarEye’research report has revealed that although 57% of retailers have outsourced their delivery networks over the past five years, 84% of retailers claim their organization needs more control over their outsourced delivery networks.

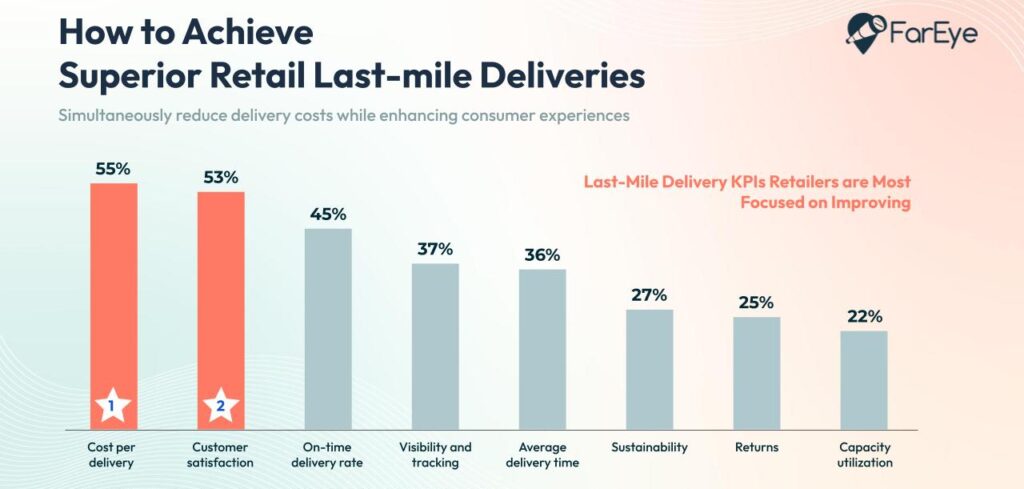

The report – Eye on Last-mile Delivery – was conducted in partnership with custom survey company Researchscape International. The trend of retailers outsourcing their delivery networks contrasted with the finding that only 27% of the surveyed retailers use a single last-mile delivery platform – yet 72% believed it to be extremely or very beneficial to merge all technology solutions into one platform (offering a single view, more agility, control and lower cost). Alongside this, 55% of retailers were focused on reducing delivery cost over the next five years, in addition to increasing customer satisfaction (53%) as their top two priorities.

The major contributors to the high cost of last-mile delivery included fuel (59%), address location (39%), labor (36%) and first delivery failure (34%). Speed of deliveries was also a contributing factor, with only 44% of retailers reporting all or almost all of their deliveries being made on time. Retailers are seeking to increase that rate to nearly 70% in 2027. At the same time, 35% of retailers currently offer same- or next-day delivery but 64% aim to offer it by 2027.

In terms of the last-mile delivery outlook, 66% of the retailers surveyed expected their budgets for last-mile delivery technology to grow over the next five years. Additionally, 78% claimed they will likely change or buy a new last-mile delivery solution in the next one to two years. The report also highlighted that 48% of retailers expect to buy a last-mile delivery platform in the next five years, versus building their own in-house (32%).

Retailers also reported plans to expand their carrier fleets to be more sustainable by 2027. 60% of EMEA and APAC respondents and 40% of US respondents planned to use electric vehicles in their fleets in the next five years. Autonomous vehicles were found to be a priority for 43% of APAC respondents, 25% of US and 20% of EMEA respondents, while drones were a priority for 34% of APAC respondents, 29% of EMEA respondents and 22% of US respondents, over the next five years.

The outsourced delivery control issue was found to result from a complex, expensive, inefficient and unsustainable process brought on by the pandemic shopping trends. The researchers concluded that outsourced delivery networks yield lower costs, faster delivery and increased capacity but sacrifice control over order tracking and a branded consumer experience.